#10: Volatilty in oil

Thoughts on the oil market, OPEC+ cuts and more.

Summary

OPEC+ announced further cuts in oil production of 1.2mn b/d from May until the end of the year.

See limited impact on actual supply as OPEC+ is already underproducing relative to their existing quota.

OPEC+’s ‘precautionary cut’ confirms demand is undershooting their expectations so far in 2023.

Still expect oil to be rangebound to slightly higher following the rally over the last week.

Backdrop:

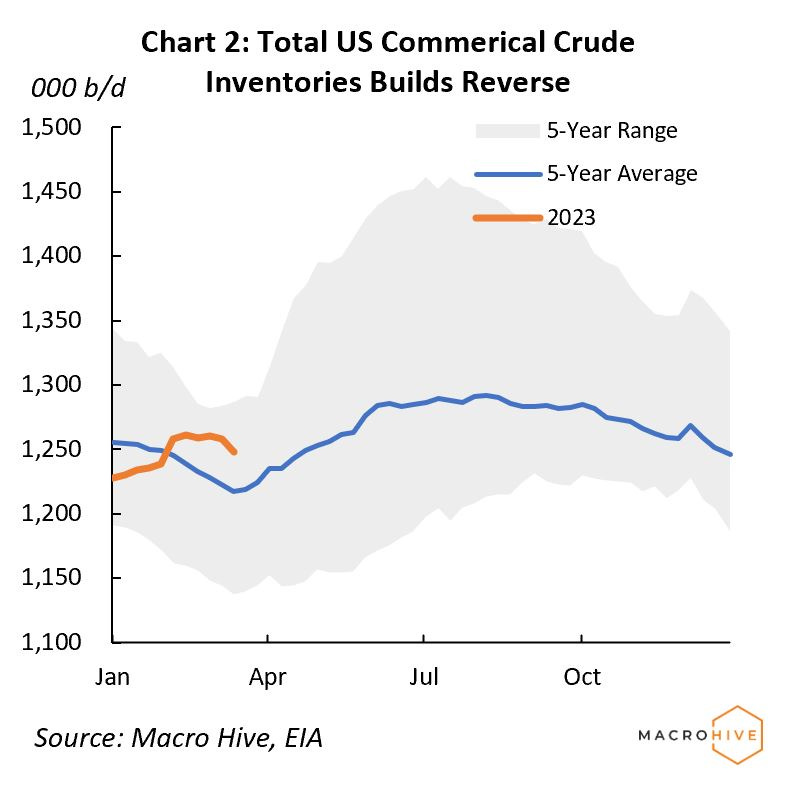

US inventories in particular have expanded considerably this year. Total crude and product stocks rose by c. 53mn barrels from the start of the year to the end of February 2023. Since then, there have been two consecutive weeks of large draws, reducing the year-to-date inventory build to c. 43mn barrels.

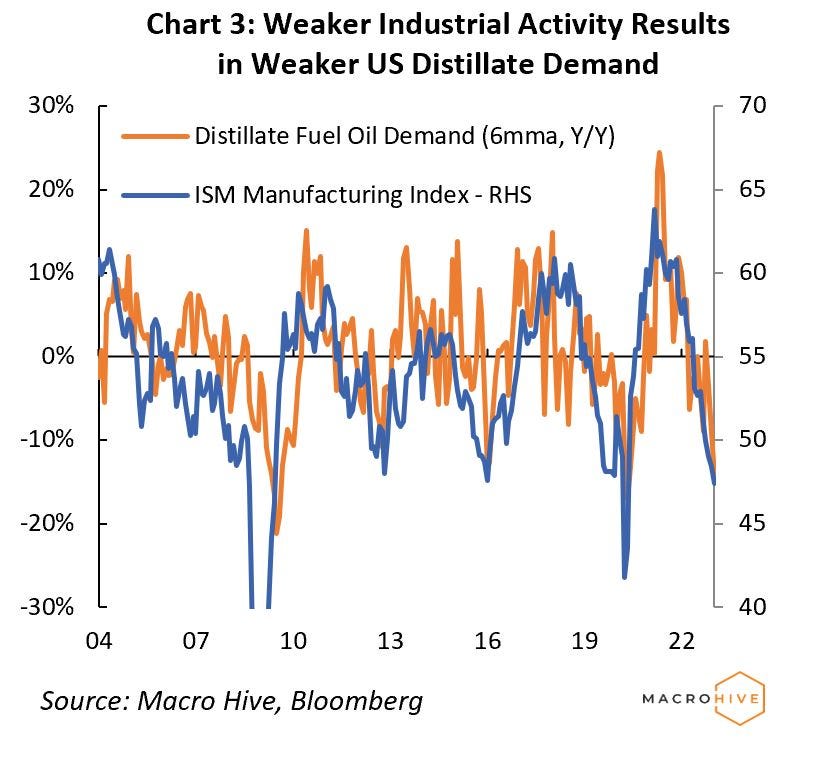

One driver for higher inventories has been sluggish industrial activity, as shown by the PMIs. For instance, US demand for distillates – used in manufacturing, freight transportation, and construction – has been particularly weak.

Europe also appears to have accelerated imports of refined products before year end in anticipation of further sanctions against Russia, ensuring ample supply.

Near Term Downside Should Be Capped

Three factors should cap downside in oil prices this year: the China reopening, a washout in net positioning, and a fall in active oil rigs.

First, the main driver supporting oil prices this year is the ongoing reopening in China.

China continues to take a larger share of global oil demand – estimated at c. 15% at the end of 2019. Our high-frequency indicators still show activity remains high even beyond the Lunar New Year.

China’s reopening should impact the oil price in two direct ways:

Via increased jet fuel demand as the number of flights increases over 2022.

Via increased gasoline as diesel usage as a transportation-related activity bounces back.

The reopening is forecast to add 0.6-0.9mn barrels a day to global oil demand.

Second, the decline in oil prices over the last few weeks has resulted in a record wash-out in net positioning. Data from ICE and CFTC showed that the net long bias for the managed money (MM) component of the Commitment of Traders (CoT) report has fallen by 233,157 contracts over the last two weeks – or almost 500bp as a percentage of open interest.

Finally, lower oil prices have already begun to impact US drilling activity. The latest figures from Backer Hughes show active oil rigs in the US have fallen by 21 this year to 600.

OPEC+ Cuts:

Limited Impact on Actual Supply

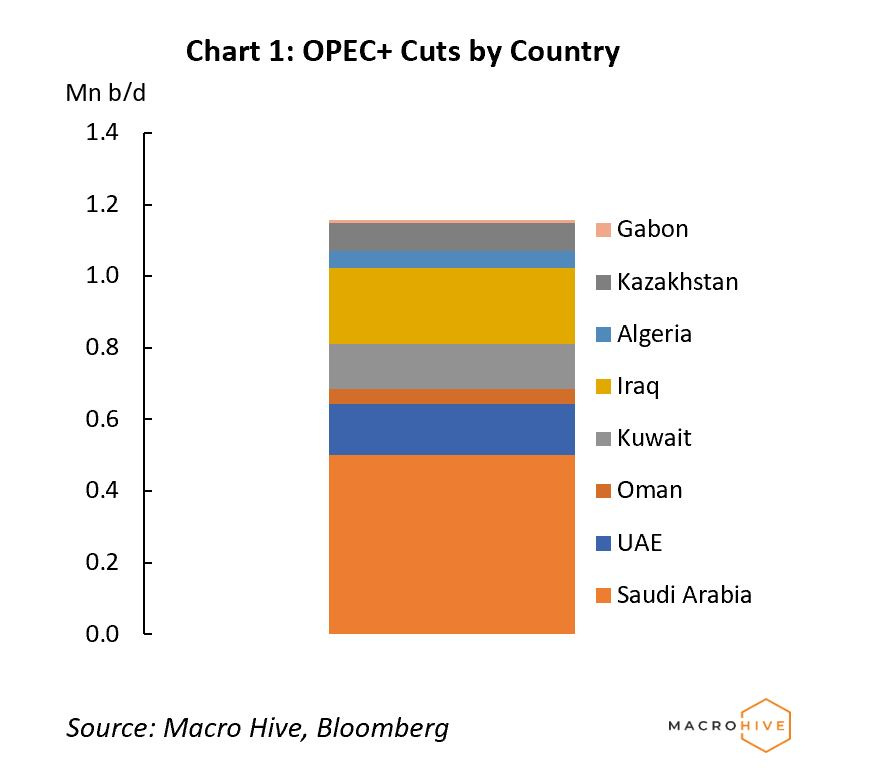

OPEC+ announced further cuts in oil production of 1.2mn barrels a day (b/d) – about 1% of global oil supply – from May until the end of the year. The cuts total 1.6mn barrels when including the extension of the 0.5mn b/d cut announced by Russia last month.

The move surprised the market as OPEC+ delegates indicated to Reuters just last Thursday that changes to its existing supply quota were unlikely following the 2mn b/d cut announced last October.

Chart 1 shows the breakdown of the 1.2mn b/d by country.

However, it is likely that the impact on global supply is likely far lower than the 1.6mn b/d indicated by OPEC+.

The main reason for this is that OPEC+ has been underproducing relative to the existing quota announced last year. Following the announcement of the 2mn b/d cut in October, OPEC+’s production ‘quota’ fell to around 25.4mn b/d while three-month production averaged around 24.5mn b/d at the end of February.

This means the actual level of cut required by ‘OPEC 10’ members in totality to fulfil the new announcement is around 0.1mn b/d.

Another reason is that interpreting Russia’s statements about production cuts has become harder.

For instance, despite Russia committing to a production quota of 10.5mn b/d in November, its total liquids production has remained strong at around 11mn b/d over the last three months. Also unclear is whether its production cuts would directly impact crude exports or just result in less demand internally.

Therefore supply cuts are more likely to be in the 0.8-1.0mn b/d range based on announcements from the larger ‘OPEC-10’ members while including some reduction in Russia’s production due to the uncertainty involved.

Cuts Confirm Environment of Weaker Demand Growth

The announcement of cuts on a ‘precautionary’ basis confirms that OPEC+ believes we are in an environment of weaker demand growth.

As shown above, weaker industrial activity is consistent with weaker distillate fuel demand, which is capping the oil price despite higher gasoline and jet fuel demand in China.

Market implications

Oil prices should remain broadly rangebound to slightly higher over the next few months at c.$80 a barrel on WTI. Remember, OPEC+ cuts only come into effect from May onwards (even then I think it is more likely to be June).

The supply cuts announced are unlikely to result in a large spike in the oil price given the ongoing demand environment. However, I think the probability of a sharp fall in WTI is limited given the better balance between demand and supply relative to Q4 last year. The risk to the upside is due to driving season in the US which starts in May (the largest single source of oil demand - gasoline).

Therefore, the impact on monetary policy is likely to be limited in the near term. Policymakers can look through the initial reaction and continue to focus on core services inflation and financial stability risks in the months ahead.

Really excellent take